Face Value Forward Contract . the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. learn how to price and value swaps, futures, and forward contracts with cfa institute. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. Understand the formulas needed for. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at.

from analystprep.com

learn how to price and value swaps, futures, and forward contracts with cfa institute. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. Understand the formulas needed for. forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at.

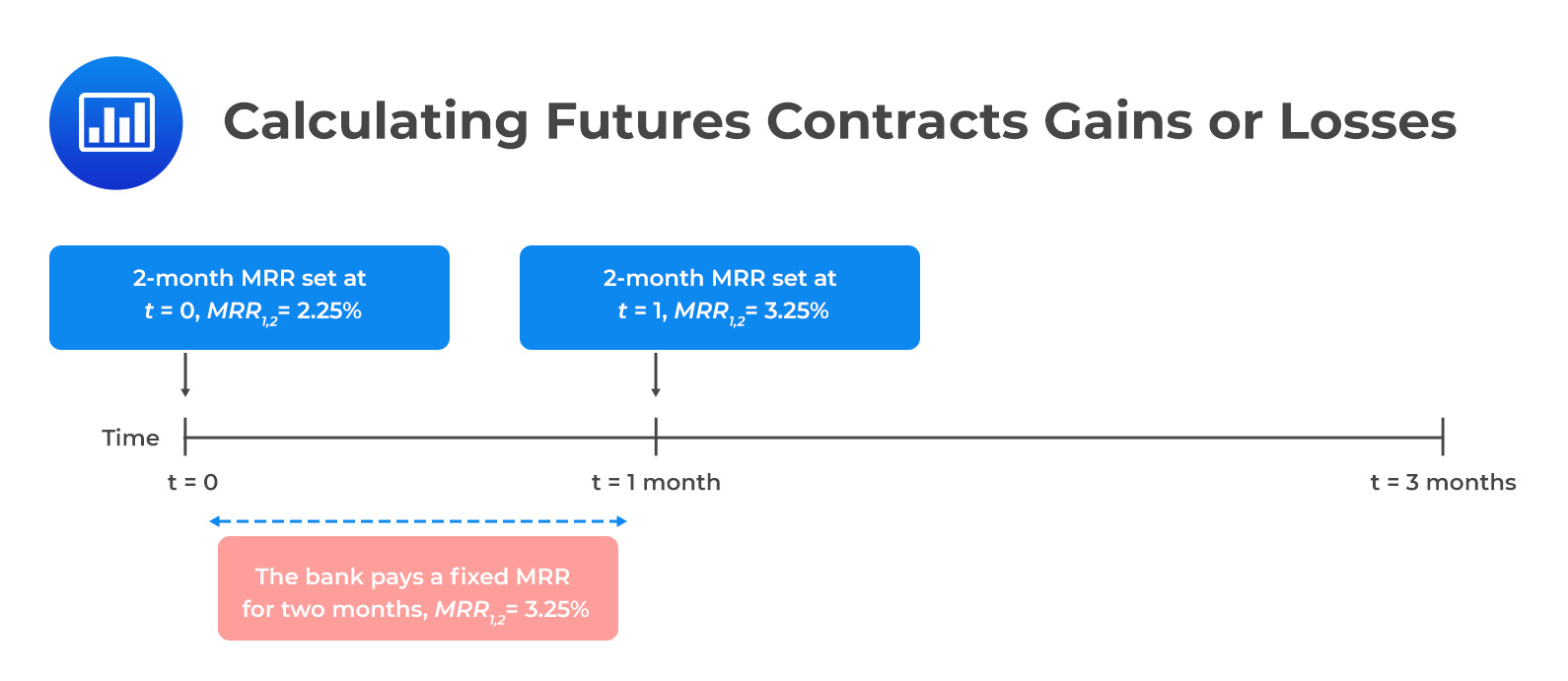

Value and Price of Futures Contracts AnalystPrep CFA® Exam Study Notes

Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. learn how to price and value swaps, futures, and forward contracts with cfa institute. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. Understand the formulas needed for.

From www.slideserve.com

PPT Forward contract PowerPoint Presentation, free download ID4087627 Face Value Forward Contract the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. learn how to price and value swaps, futures, and forward contracts with cfa institute. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. let’s. Face Value Forward Contract.

From zachblas.info

face value Zach Blas Face Value Forward Contract the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. Understand the formulas needed for. learn how to price and value swaps, futures, and forward contracts with cfa institute. forward price is the price at which a seller delivers an underlying asset, financial derivative,. Face Value Forward Contract.

From info.techwallp.xyz

Futures Market Value Calculation Management And Leadership Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. Understand the formulas needed for. let’s examine how the price and value of a forward contract are determined. Face Value Forward Contract.

From www.slideserve.com

PPT Futures Contracts PowerPoint Presentation, free download ID1406723 Face Value Forward Contract let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. forward price is the price at which a seller delivers an. Face Value Forward Contract.

From www.slideserve.com

PPT Derivatives Introduction PowerPoint Presentation, free download Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. forward price refers to the predetermined and agreed upon price of an underlying asset in. Face Value Forward Contract.

From www.pdffiller.com

forward contract Doc Template pdfFiller Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. Understand the formulas needed for. the value of a forward contract prior to expiration is the value of the asset. Face Value Forward Contract.

From tradebrains.in

What are Forward Contracts? And How do they work!! Trade Brains Face Value Forward Contract Understand the formulas needed for. learn how to price and value swaps, futures, and forward contracts with cfa institute. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. the value of a forward contract prior to expiration is the value of the asset. Face Value Forward Contract.

From www.slideserve.com

PPT Chapter 5 Valuation of Forwards & Futures PowerPoint Face Value Forward Contract learn how to price and value swaps, futures, and forward contracts with cfa institute. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the. Face Value Forward Contract.

From www.studocu.com

FACE Value description What Is Face Value? Face value is a Face Value Forward Contract let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. learn how to price and value swaps, futures, and forward contracts. Face Value Forward Contract.

From www.investopedia.com

Futures Contract Definition Types, Mechanics, and Uses in Trading Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. learn how to price and value swaps, futures, and forward contracts with cfa institute. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. A. Face Value Forward Contract.

From www.youtube.com

Valuation and Market Value Forward Contracts YouTube Face Value Forward Contract Understand the formulas needed for. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. the value of a forward contract prior to expiration is the value of the asset minus the present value of the forward price. forward price refers to the predetermined and agreed upon. Face Value Forward Contract.

From www.pricederivatives.com

How to value FX forward pricing example Face Value Forward Contract let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. learn how to price and value swaps, futures, and forward contracts with cfa institute. Understand the formulas needed for. forward price is the price at which a seller delivers an underlying asset, financial derivative,. Face Value Forward Contract.

From www.slideserve.com

PPT Forward contracts PowerPoint Presentation, free download ID5482257 Face Value Forward Contract A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the.. Face Value Forward Contract.

From www.youtube.com

CFA Level 2 Forward Markets and Contracts in Derivatives YouTube Face Value Forward Contract let’s examine how the price and value of a forward contract are determined at initiation, during the life of the contract, and at. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. A forward contract is a customizable derivative contract between two parties to buy or sell an asset. Face Value Forward Contract.

From www.sampletemplatess.com

Freight Forwarding Contract Template SampleTemplatess SampleTemplatess Face Value Forward Contract A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. Understand the formulas needed for. forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. let’s examine how the price and value of a forward contract are determined. Face Value Forward Contract.

From www.startswithy.com

FACE VALUE in a Sentence Examples 21 Ways to Use Face Value Face Value Forward Contract learn how to price and value swaps, futures, and forward contracts with cfa institute. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. Understand the formulas needed for. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract.. Face Value Forward Contract.

From forexea90accuracy.blogspot.com

Forex Futures Contracts Forex Ea 90 Accuracy Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract.. Face Value Forward Contract.

From efinancemanagement.com

Forward Rate Agreement Meaning, Features, Example and More Face Value Forward Contract forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the. forward price refers to the predetermined and agreed upon price of an underlying asset in a forward contract. let’s examine how the price and value of a forward contract are determined at initiation, during the life of the. Face Value Forward Contract.